Article

4 Strategies to Build a Successful Business in the Competitive Digital Diabetes Market

May 03,2023

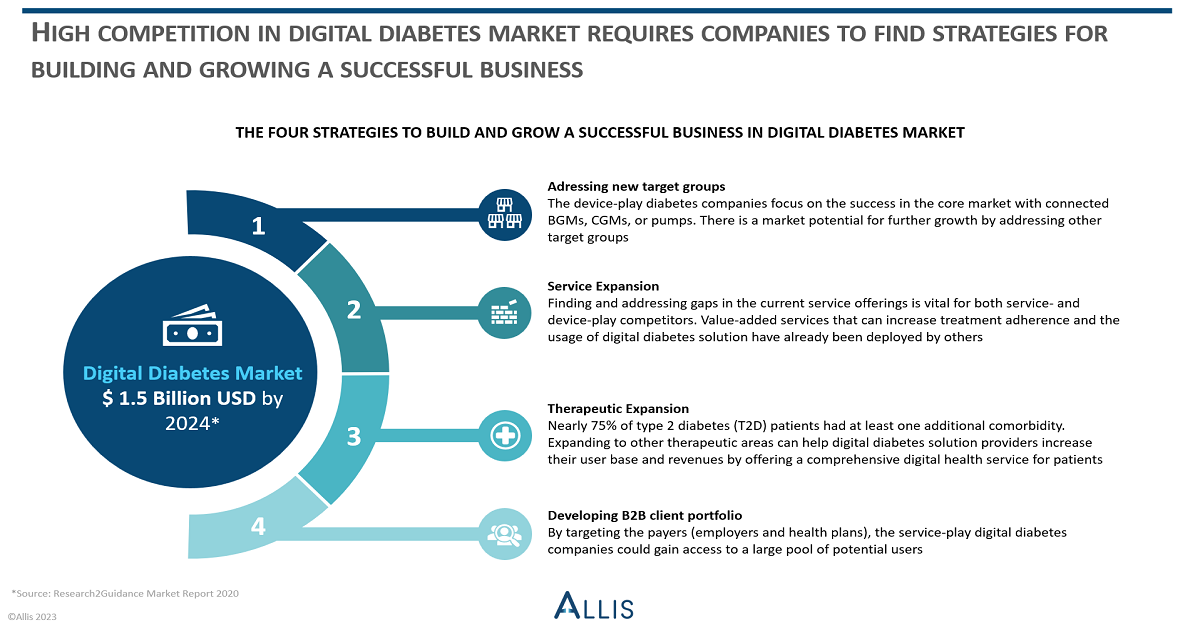

Competing in a mature digital health market like diabetes is no small feat. There are four main strategies to grow a digital diabetes solution business.

The global digital solutions market is a rather mature digital health market segment. There are more than 2.500 solutions that are offering digital diabetes management services globally. The global digital diabetes service market is expected to grow at 37% CAGR annually, reaching USD 1.5 billion in 2024, excluding the device sales (Research2Guidance 2020).

There are two leading groups of service models in the digital diabetes market.

The first group consists of the device-play companies, offering BGM, CGM, insulin pumps, smart insulin pens, etc. connected with mobile apps and/or software solutions. Abbott, Medtronic, and Insulet are some of the successful contenders in this group.

The second group consists of the service-play companies, offering diabetes related data tracking, education, coaching, digital therapeutics etc. through mobile health apps, such as Glooko, Health2Sync, and Virta Health. Some companies in this space, like DarioHealth or Livongo by Teladoc, could as well offer bundled services with devices included.

In both groups, the competition level is rising. There are 4 strategies that the digital diabetes market players could apply to develop more successful and growing businesses:

- Addressing new target groups: The device-play diabetes companies focus on the success in the core market with connected BGMs, CGMs, or pumps. There is a market potential for further growth by addressing other target groups, such as:

- Targeting wellness markets: With decreasing CGM prices, new user groups can be addressed including the health-conscious and fitness-oriented users who can use a CGM sensor for general health and wellness tracking. Abbott already announced an upcoming consumer biosensor, Lingo, which uses its CGM technology to track glucose, ketones and lactate levels for general health and wellness tracking.

- Targeting clinical trial market: The digital decentralized clinical trial market will grow at 38.5% CAGR to USD 9.1 billion by 2026 in North America and Europe (Research2Guidance 2021). Digital diabetes solution providers often have thousands of users, capturing billions of real-world data points. Developing services, within the regulatory boundaries, to allow access to user groups and user data represent a market potential that digital diabetes providers can unlock in the near future. Medtronic already offers iPro2 CGM and connected mobile apps and dashboards for trial sponsor’s drug development as well as real world trials. Others have also started to leverage their patient pool and offer patient recruitment services for trials, by looking at in the oncology market how Belong.Life scaled up its patient community app for clinical trial matching for sponsors.

- Expanding the services: By following the emerging trends and identifying the gaps in their own services, digital diabetes service providers could develop stronger offerings. Value-added services that can increase treatment adherence and the usage of digital diabetes solution, e.g., coaching, medication reminders, educational modules, low-carb recipes, personalized tips or weight loss services, etc. have already been deployed by others. For example, DarioHealth rolled out human coaching for diabetes management way back in 2018, while LifeScan initiated partnerships with service providers in 2021, to offer weight loss and telehealth services among others, bundled with its BGM devices.

- Expanding to other therapeutic areas: According to a study, nearly 75% of type 2 diabetes (T2D) patients had at least one additional comorbidity. Hypertension and obesity are the mostly found comorbidities among T2D patients, followed by heart and kidney diseases, depression, MSK and asthma among others. Expanding to other therapeutic areas can help digital diabetes solution providers increase their user base and revenues by offering a comprehensive digital health service for patients. This is how most of today’s multi condition therapeutics platforms like Omada Health or Welldoc expanded their business in past and more examples will follow in future (Onduo & Sword health partnership in 2022).

- Developing B2B client portfolio: B2B clients, i.e., payers, present an attractive opportunity for service-play digital diabetes solution providers. By focusing on payers such as employers and health plans, these companies can tap into a larger pool of potential users. DarioHealth, for example, has reported onboarding over 100 B2B clients by the end of 2022 and generating 59% of its revenue in the same year ($27.7M USD) from B2B sources. It is important to note, however, that competition in this space is expected to be challenging in selling the bundle services to payers, and it could take time for the increasing adoption of digital health services among the employees and members.

The digital diabetes market is rapidly growing, and market players need to find ways to maintain their competitive edge. Device- and service-play digital diabetes companies can pursue four main strategies to grow a successful business, such as addressing new target groups, expanding the service offerings and therapeutic area coverage, and developing a B2B client portfolio.