Article

4 Ways to Increase the Adoption Rates of AI-Backed Digital Oncology Solutions

Apr 05,2023

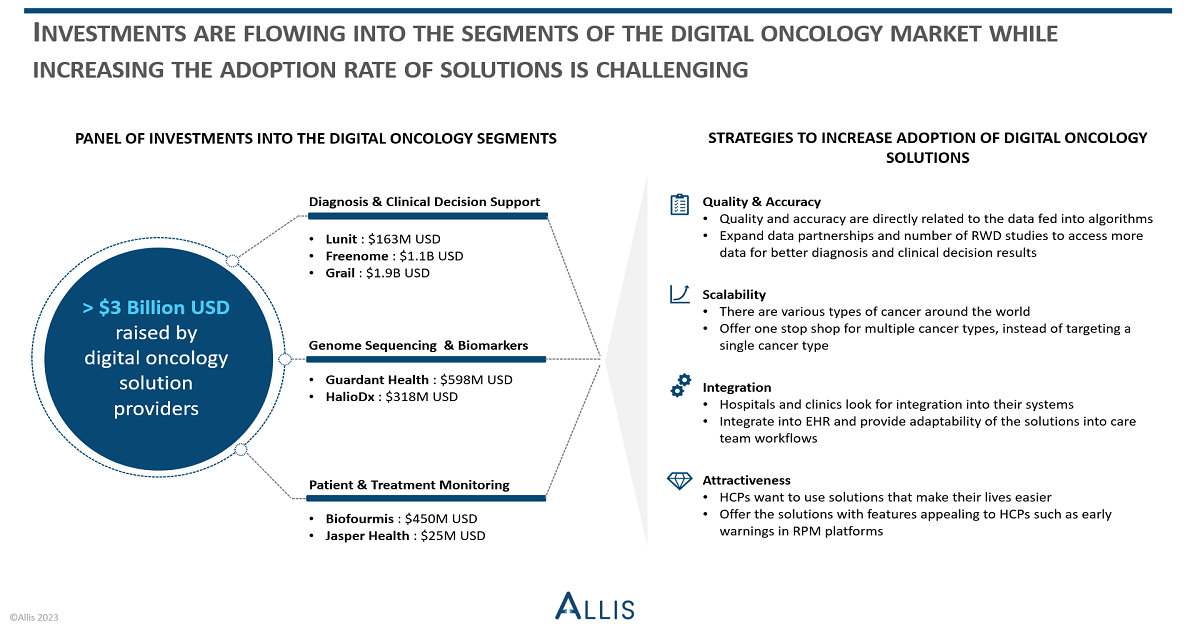

Artificial intelligence is innovating the standards in cancer treatment, and the investments keep flowing for those solutions leveraging AI in oncology. However, the adoption rate of these solutions is still questionable. There are at least 4 ways to increase adoption.

Artificial intelligence (AI) has been a game changer in oncology, providing new ways for oncologists, pathologists, and radiologists to diagnose cancer, and determine its severity, monitor patients, and personalize treatment plans. As a result, the fundings, for those digital oncology solution providers that are using AI to add value into service offerings are increasing.

Cancer detection and clinical decision support services are one of the areas where AI has been helping majorly, offering time efficiency for the HCPs by faster analysis of images, scans, and tissue test. While these solutions have been improving, so as the volume of investments for them.

For its cancer diagnosis from CT scans or X-rays, Lunit collected $61 million USD in a single round in 2021, brought its total funding more than $135 million USD, and additionally raised $28 million USD in the IPO in July 2022.

Through its novel blood test analysis for early cancer detection, Freenome raised $300 million USD in Series D in 2021, received $290 million USD from Roche in 2022, and collected over $1 billion USD in total since its foundation. With a similar service offering, Grail, the company that has been tried to be acquired by Illumina since 2020, raised $390 million USD in Series D in 2020, brought its total investments over $1.9 billion USD.

Lastly, Paige.AI, developing AI analysis tool for tissue tests and early cancer detection, raised $125 million USD in Series C in 2021, brought its total funding over $220 million USD.

Genome sequencing and biomarker analysis are another area where AI has been widely helping with finding the right treatment for the right patient, i.e., developing personalized treatments. As these solutions also offer added value for the pharma clients who would like to tap into the rare disease market with novel treatments, the fundings also keep flowing in.

Guardant Health, developing tests for genomic view of cancer types for personal treatments, secured $360 million USD in Series E in 2017, right before its IPO in 2018 in which the company collected $238 million USD. In another front, Veracyte bought Halio Dx $318 million USD in 2021, to offer the latter’s customized biomarker tests and analysis platform in oncology for the biopharma clients.

Patient and treatment monitoring solutions in digital oncology space are also leveraging AI technologies and help HCPs to monitor patients' symptoms, medication adherence, and other health metrics remotely. Fundings are increasing for these solutions too, which are valuable for making adjustments in the treatment pathway and engaging with patients.

Biofourmis, developing software solutions for monitoring in various disease areas including oncology, raised $300 million USD in Series D in 2022 and collected more than $450 million USD investments for its technology. The another RPM solution provider for cancer treatments, Jasper Health raised $25 million USD in Series A in 2022.

How to Increase the Adoption of the AI-powered Digital Oncology Solutions

Even though the solutions are being developed and investors are showing interests, the adoption rate of these AI-powered digital oncology solutions remains low. There are four ways to overcome this issue:

- Quality & Accuracy: Quality is important as the accuracy of AI-tools for adoption. Both are directly related to the amount and quality of data fed into the algorithms. Developers can increase the data pool by launching real-world data studies and adding more data partnerships. For example, Paige.AI leveraged its partnership with the Memorial Sloan Kettering to access real-word medical images in 2017, while also launching studies with research partners like Oxford University.

- Scalability: The cancer agnostic digital oncology solutions can offer one stop shop for multiple cancer types, instead of targeting a single cancer type. This is also appealing for the care facilities and other stakeholders, not to deal with multiple vendors for each cancer type. Kaiku Health offers its patient monitoring platform for cancer clinics for breast, melanoma, lung, head and neck, and many other cancer types, and this led to partnerships with universities and pharma partners, for clinical trials and R&D in various cancer types.

- Integration: EHR integration and solution adaptability to care team workflows are important factors for clinics and hospitals looking for digital oncology solutions. While offering value additions with AI technologies, the solution developers can also increase their adoption rates via easy integration of their solutions. For example, Carevive already offers a bi-directional EHR integration, which does not create a friction in the routine care workflow of care facilities.

- Attractiveness: In order to onboard HCPs with the AI-based digital oncology solutions, the solutions must be loaded with features that can make their lives easier. This could be an early alert feature for care teams for out-of-range health values from the patients, or better patient information and engagement features to assure treatment adherence of patients. For example, Jasper Health offers an RPM solution not only with EHR integration, but also with patient onboarding, education, coaching as well as the alerts for care teams.

There are many areas where AI and machine learning algorithms can transform the pain points in the cancer diagnosis and treatment. The market is getting more interesting with further developments and investments, however like every other digital health solution, these new technologies will need adoption. By increasing quality, scalability, integration and attractiveness, the AI-based digital oncology solution developers can expand their client bases.