Article

500 Partnerships and Counting: The Power of Ecosystems in the Digital Diabetes Market

Jul 13,2023

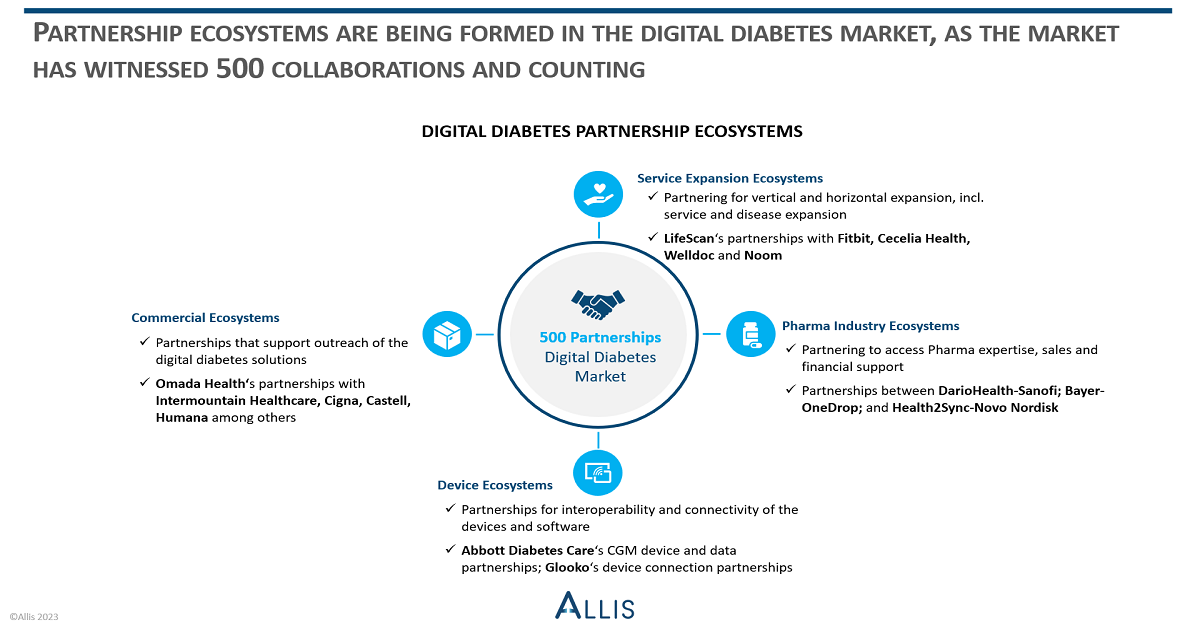

As 500 partnerships recorded in digital diabetes, there are four types of partnership ecosystems emerged. Building ecosystems is becoming one of the main go-to-market strategies for some digital diabetes solution providers.

Within digital diabetes market landscape, partnership ecosystems have emerged as strategic collaborations among various stakeholders to develop new solutions, offer a holistic care experience, and explore further growth opportunities in the market segment.

Allis recorded 500 partnership deals closed in the digital diabetes market segment since 2014. Total number of partnerships deals signed in 2022 is seven times higher than in 2014. The peak years of the number of digital diabetes collaborations were Y2019 and Y2020, with above 70 partnerships recorded each year.

In H1 2023, digital diabetes market also witnessed more than 20 partnerships, closed with pharmaceuticals, telemedicine providers, health plans, pharmacy benefit managers, among others.

Welldoc has signed a joint partnership with Astellas Pharma and Roche Diabetes Care for development and commercialization of Accu-Chek Guide Me BGM system with Welldoc’s BlueStar platform in Japan.

Diabeloop and Novo Nordisk signed a connected device partnership to enable interoperability between the Diabeloop’s insulin management software and Novo Nordisk smart insulin pens.

DarioHealth closed a strategic partnership with Amwell to deliver its full suite chronic condition management platform to Amwell customers.

Additionally, Vida Health started a partnership with SelectHealth, a health plan in the US, to provide Vida’s cardiometabolic solutions incl. diabetes to its members.

While range of partnerships are being formed, there have been mainly four types of ecosystems emerging in the digital diabetes market.

- Service Expansion Ecosystems: Digital diabetes solution providers keep expanding their service offerings vertically and horizontally through partnerships and aiming for holistic care services incl. diabetes and its comorbidities. In 2021, LifeScan’s OneTouch Solutions marketplace was built through a slew of partnerships with Fitbit, Noom, Cecelia Health and Welldoc, to offer coaching, weight loss, telehealth services in a bundle with its BGMs. Onduo by Verily expanded into MSK condition in its diabetes management platform, by partnering with Sword Health in MSK therapy.

- Pharma Industry Ecosystems: Digital diabetes solution providers explore partnerships with the pharmaceutical companies for joint research and development projects, utilizing pharma’s expertise and sales force in healthcare, and gathering financial support. DarioHealth-Sanofi partnership in Q1 2022 and One Drop-Bayer partnership in Q3 2020 are some examples in the market, which help DarioHealth and One Drop to get commercialization support from Sanofi and Bayer, and investments to develop new offerings for other disease segments.

- Device Ecosystems: As the digital diabetes technologies and services get diverse, the need for interoperability and connectivity among the solutions increases. Device ecosystems support the integration of various solutions through partnerships. Abbott Diabetes Care have formed partnerships with more than 20 digital health companies such as Omada Health, Insulet, Ypsomed etc., to integrate its CGM sensors and data into various platforms, technology and service providers. Glooko has also built its own device ecosystem incl. Novo Nordisk, LifeScan, Ascensia Diabetes and others to connect devices and collect data in its diabetes data management software.

- Commercial Ecosystems: Commercial ecosystems support the distribution of the digital diabetes solutions and reach out to more users with range of client partners such as health plans, pharmacy benefits, health systems and employers. Omada Health expanded its commercial partnerships with Intermountain Healthcare, Cigna, Castell, Humana and more, which all in turn help with accessing larger patient populations more efficiently and increasing number of enrolled users eventually.

The number of partnerships is growing in the digital diabetes market. Market players do not stop with one or two partnerships but forming their own ecosystems with range of stakeholders. Their collaborations span across various types of ecosystems, including service expansion, pharma industry, device, and commercial ecosystems. As the market and the competition keep growing, businesses will engage more actively in these ecosystems to seize opportunities for business growth and improved services.