Article

Breaking Down the $9B Investments in Digital Diabetes: Which Service Areas Dominate?

Jun 23,2023

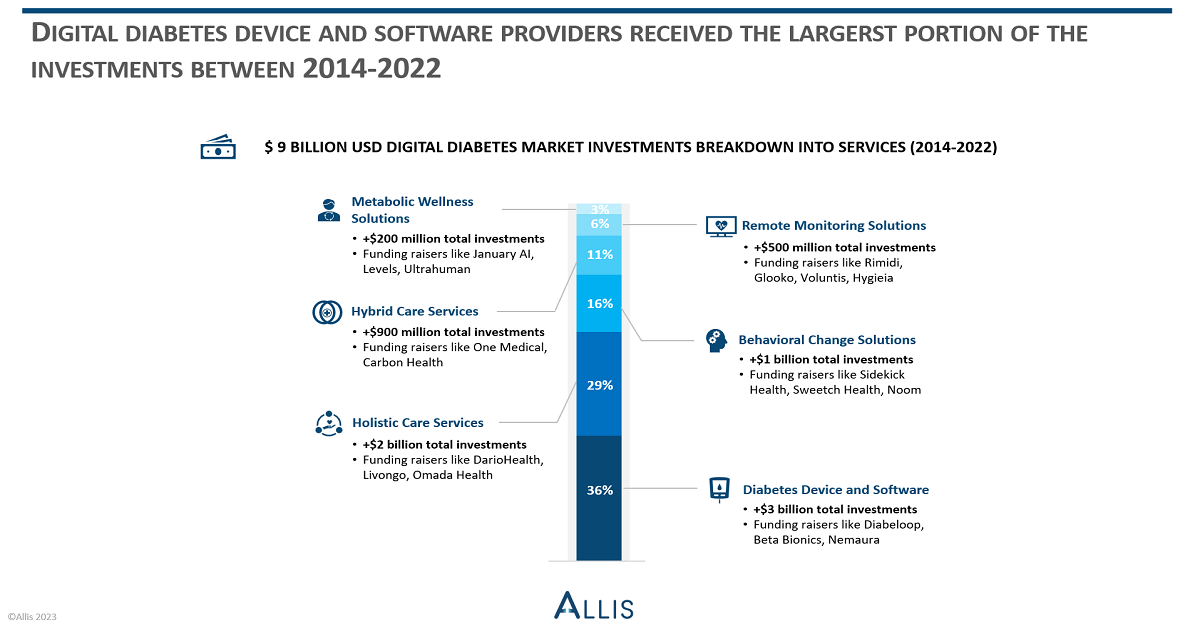

Digital diabetes solutions market received approx. $9B USD investments between 2014-2022. Six key service areas stand out as the main recipients of fundings, including one clear winner.

Digital diabetes market refers to the digitally delivered solutions and services for people with diabetes, including BGMs, CGMs, insulin pumps/pens, clinical decision support software, mobile applications, self-management platforms, RPM, telehealth, and hybrid care services.

Thanks to the increasing support from the investors, the market continues to grow since 2014. The market segment attracted more than 260 investors between 2014-2022. During the same period, digital diabetes market competitors gathered close to $9 billion USD investments in 320 funding rounds (Allis.health). The average investment amount per funding round stands at $28 million USD.

The funding amounts in the segment has reached a tipping point in 2021. During the COVID-19 global pandemic, yearly total investment amount was near $3 billion USD, with a YoY growth of 86%. The compound annual growth rate (CAGR) of the investment amounts between 2014-2021 had reached to 27% at the time.

Some of the prominent money raisers in 2021 were Noom ($540M USD), Carbon Health ($350M USD) and MicroTech Medical ($255M USD in IPO). The average investment amount per round in 2021 for the digital diabetes solution providers was approx. $60 million USD.

In 2022, the number of investment rounds (24 rounds) decreased and the yearly funding amount ($674M USD; -280% YoY decrease) got smaller, compared to the previous year. This can also be translated as getting back to normalcy in the investment landscape. However, it is important to note that the third and fourth quarters of 2022 were particularly dry in terms of investment activity in the digital diabetes market.

Overall, there are six digital diabetes solution and service areas which have received fundings between 2014-2022 period:

- Smart device and connected software, 35%: The diabetes device manufacturers and connected software developers such as Beta Bionics, Nemaura, Diabeloop have received 35% of the total market investments since 2014. This is also the service area which received the largest portion of the yearly market investments between 2017-2020. The core service offering consists of the monitoring devices like BGMs, CGMs, smart insulin pens or insulin pumps, which usually come with a connected software and/or mobile application to track, record, display and analyze the user data efficiently.

- Holistic care service, 29%: The digital holistic diabetes care providers are the close competitors of device and software providers in terms of the investments, as they have accounted for 29% of the total market investments since 2014. They offer bundle services mostly, including devices & accessories, coaching, care planning, data logbook, among others. Some of the solution providers also offer services for multiple conditions in a single platform like Omada Health, DarioHealth or Livongo, targeting the comorbidities of diabetes. The digital holistic diabetes care providers received the highest amount of investment in 2022, compared to the other service categories.

- Behavioral change solutions, 16%: Behavioral change solutions for chronic conditions like diabetes received 16% of total market investments between 2014-2022. These solutions offer personalized programs and coaching services to help users improve their lifestyle, change unhealthy behavior and effectively prevent or manage diabetes. Notable players in this category include Sidekick Health, Sweetch Health, and Noom. In 2021, behavioral change solutions for diabetes received the highest investments among all service categories.

- Hybrid care service, 11%: Hybrid care providers which mix the point-of-care with digitally delivered specialty care including diabetes have gathered 11% of the total digital diabetes investments since 2014. In diabetes care packages, they usually offer coaching, personalized care and dietary plans, endocrinologist visits, care team chat, patient education, and prescriptions. Some of the hybrid diabetes care providers who have received fundings include Carbon Health and One Medical.

- Remote monitoring software, 6%: Remote patient monitoring providers, including insulin dosing software developers, received 6% of total market investments in the digital diabetes market since 2014. These solutions generally enable data sharing efficiently between patient apps and healthcare professional portals, while some also assist with clinical decisions and alerting care teams when vital signs are abnormal. Notable players in this category who have attracted the investors’ attention are Glooko, Voluntis, Hygieia, and Rimidi.

- Metabolic wellness solutions, 3%: The metabolic wellness tracking service segment is the least funded area of the digital diabetes market, with nearing 3% of the total investments between 2014-2022. The competitors offer tracking solution for meals, glucose, and other metabolic levels, and providing insights on the general metabolic health. Services in this area are accessible mostly through mobile apps connected to wearable devices like CGMs or other sensing patches. Competitors who received funding since 2014 include Levels, January AI, and Ultrahuman.

The digital diabetes solutions market has witnessed substantial investments, totalling approximately $9 billion USD since 2014. Overall, the market continues to evolve, driven by the increasing support from investors. Among the various service areas, smart device and connected software solutions have received the largest portion of the total market investments. These are followed by holistic care services, behavioral change solutions, hybrid care services, remote monitoring software, and metabolic wellness solutions.