Article

Diabetes App Downloads Grew By 21% CAGR, Reaching 23M In 2023. Top27 Capture 50%

Oct 13,2023

Global mobile diabetes app market size and total download numbers keep growing steadily. There is one service provider group reaping most of the app downloads in the market.

App downloads data, especially in the competitive digital diabetes market, is one of the indicators to understand if the solution is resonating with the target audience.

Today, there is approx. 3,000 applications published globally on Google Play and Apple App Stores, offering a range of services for diabetes management. The growth rate (CAGR) of the number of diabetes applications operating on iOS and Android systems has reached to 16% between 2012-2022.

The applications accumulated over 20 million downloads over the course of 2022 only, while this number was close to 9 million in 2018 (R2G). The growth rate (CAGR) of the diabetes app downloads has reached to 21% between 2018-2022. The diabetes applications are expected to gather close to 23 million downloads by the end of the 2023, growth of 15% YoY.

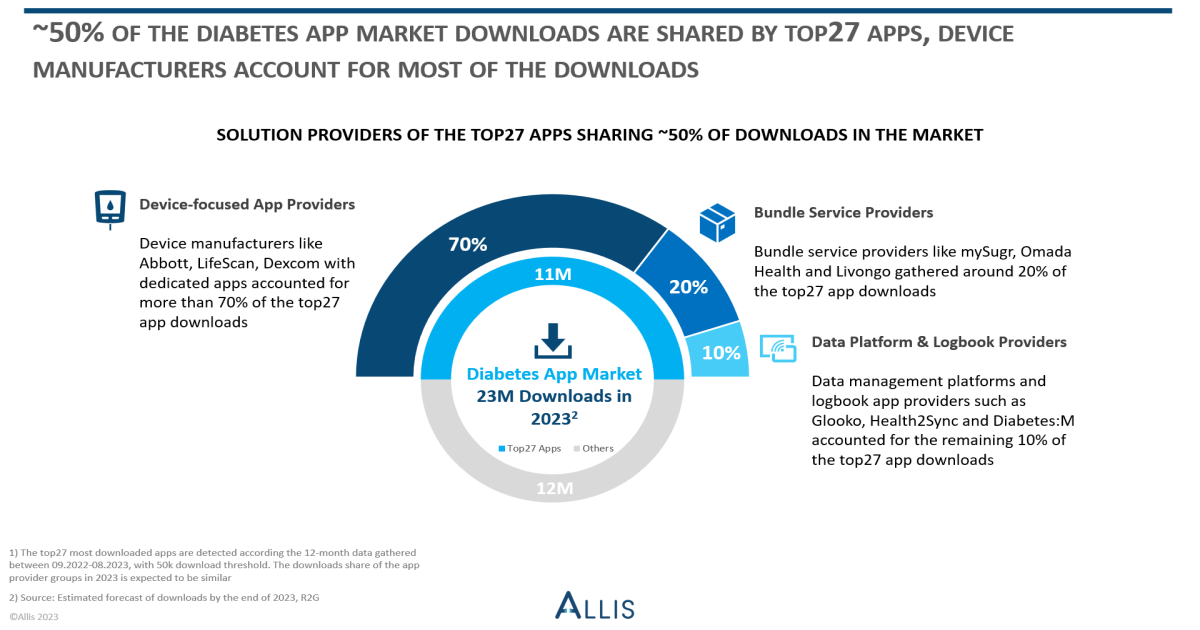

Between Sept 2022-Aug 2023, there were 27 diabetes applications (‘’top27’’) who crossed the 50 thousand total global downloads threshold, accounting for ~50% of the global diabetes app downloads. During the same period, the top 10 most downloaded diabetes applications accounted for more than 9 million downloads altogether.

Among the top27 apps, Abbott Diabetes Care’s FreeStyle LibreLink has claimed the pole position, with over 2 million downloads within a 12-month period (Sept 2022-Aug 2023). Abbott's newer additions to their mobile app portfolio, FreeStyle Libre 2 and 3, have also secured coveted spots within the top 10 rankings.

On another front, mySugr clinches the 3rd position, while Dexcom’s Clarity and G6 apps take the 5th and 6th spots, respectively, in the app downloads ranking.

Dexcom’s two apps are closely followed by LifeScan’s OneTouch Reveal app, marking it as one of the best performing mobile diabetes apps from the BGM device providers.

There are mainly 3 groups of service providers sharing the top27 app downloads in the digital diabetes market, between Sept 2022-Aug 2023:

- Device-focused app providers (70%): Device manufacturers (CGM, BGM, insulin pump, etc) with dedicated apps accounted for more than 70% of the top27 app downloads in the 12-month period. Abbott, Dexcom, LifeScan, Tandem Diabetes, Ascensia are some of the leading device-focused competitors in the mobile diabetes app market globally. The main service offerings in their apps include automatic data sync from devices, logbooks for medication and food intake, dashboards, trends and alerts.

- Bundle service providers (20%): Bundle service providers gathered around 20% of the top27 app downloads. The digital diabetes bundles typically include connected devices with accessories and premium app subscriptions offering AI/human coaching, weekly lessons, data logbook and dashboards among other advanced features. Omada Health, Livongo, mySugr and BeatO Diabetes are among the major competitors with bundle services and highest download rates in the market.

- Data platform & logbook providers (10%): Data management platforms and logbook app providers such as Glooko, Health2Sync and Diabetes:M accounted for the remaining 10% of the top27 app downloads. Most of the publishers in this category offer both a patient app and HCP portal, with auto/manual data sync from devices, food and medication logbook, trend detection, dashboards, data sharing, and reminders features. Some include educational sources, recommendations, meal planners, and AI chatbots as well.

The global mobile diabetes app market is on the rise, with downloads increasing steadily. With nearly 3,000 global apps, 2022 saw over 20 million downloads. Abbott Diabetes Care's FreeStyle LibreLink is currently leading the charts of top diabetes apps with highest downloads. The top 27 app downloads are mainly shared by device-focused providers, bundle service providers, and data platform & logbook providers. The market data shows that true companion solutions from diabetes device manufacturers are shaping the evolving landscape of diabetes management apps.