Article

More Than 300 Partnerships in Digital Oncology Market Since 2014, What Are the Main Areas?

May 05,2023

The number of partnerships in the digital oncology market reached to more than 80 deals in 2022. There are four main partnership areas. One area stands out as the most targeted.

Digital oncology solution market can be divided into three, not mutually exclusive, sub-segments: the patient support solutions, the medical care team solutions, and the research solutions.

- Patient Support Solutions: They typically offer symptom tracking and management, patient education, coaching, clinical trial matching, peer support, etc., to increase patient engagement and adherence during treatment processes.

- Medical Care Team Solutions: These solutions offer remote patient monitoring (RPM), clinical decision support tools, medical diagnostics, and treatment planning. Some of the services from patient support solutions could also be offered in the medical care team solutions, e.g., symptom tracking in the RPM solutions.

- Research Solutions: Research solutions refer to those software solutions for drug development and clinical research, with services ranging from genomic sequencing and biomarker detection to real-world data and evidence generation. Some services like patient vs. trial matching or diagnostic tests can be included in the research solutions as well.

Partnerships are seen as a main source of innovation in the market. Especially pharma and medtech companies, hospitals, and digital health companies have been actively closing partnerships with 3rd party digital oncology solution providers.

Allis recorded more than 300 partnership deals for the digital oncology solutions from 2014 to March 2023. The partnerships in the digital oncology market segment reached its peak in 2022. The number of partnerships kept growing since 2014, from 5 partnerships deals to more than 80 deals in 2022.

The Q1 2023 has also started with partnership deals in digital oncology solutions market, such as the strategic collaboration between AI-enabled precision medicine company Tempus and Pfizer.

Digital cancer care company Careology signed a collaboration agreement with Royal Marsden NHS Trust to offer mental health support services for cancer patients, also in Q1 2023.

Cancer care and clinical decision support solution provider Viecure partnered with diagnostic tests provider Exact Sciences in March 2023, to offer the latter’s genomic tests in the Viecure platform.

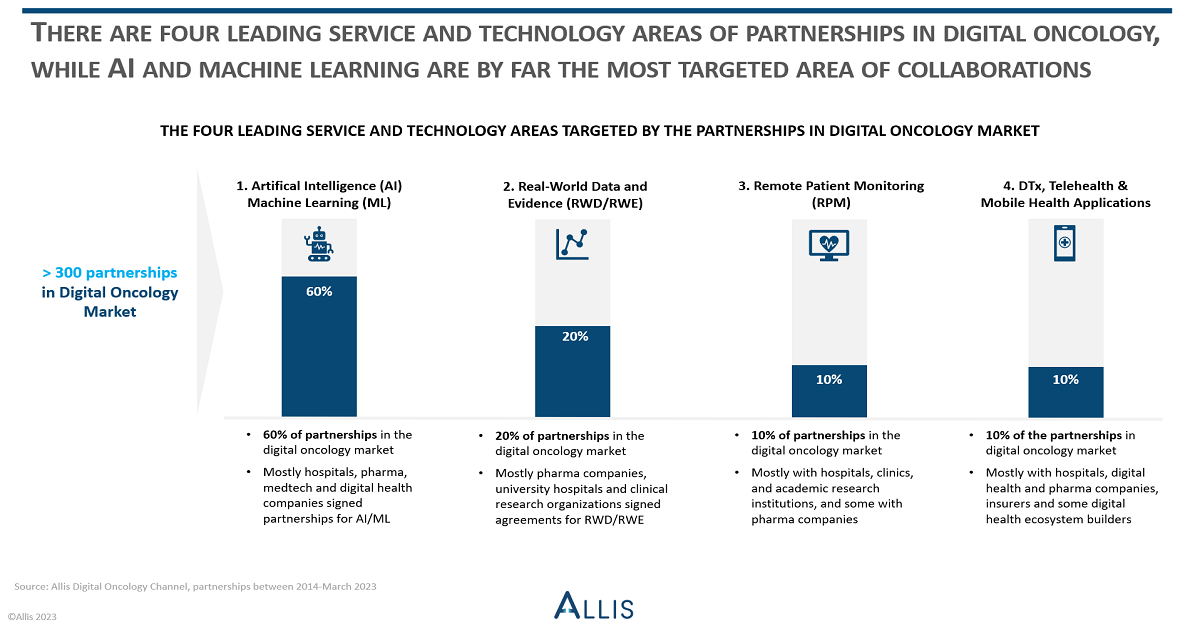

There are 4 main partnership areas in the digital oncology market:

- Artificial Intelligence/Machine Learning (AI/ML), 60%: The AI/ML technologies have been the most targeted area by the partnerships in digital oncology market. On average 60% of partnerships in each year are about AI/ML technologies and related software solutions in the market, according to Allis. The AI/ML technologies are used in all digital oncology subsegments, e.g., in personalized tips generation for patients, in cancer diagnosis through image recognition, or in genomic sequencing and biomarker detection. Most of the partnerships for these technologies have been with hospitals, pharmaceutical companies, medtech and digital health companies.

- Real-World Data (RWD) and Real-World Evidence (RWE), 20%: On average 20% of partnerships in the digital oncology market in each year are about the RWD and RWE according to Allis. RWD and RWE solutions help majorly the pharmaceutical companies during the clinical trial research processes, assessing the safety and effectiveness of their drug treatments. Consequently, most of the RWD/RWE related partnerships are signed with the pharma companies in digital oncology market, followed by university hospitals and clinical research organizations.

- Remote Patient Monitoring (RPM), 10%: On average 10% of partnerships in the digital oncology market in each year have been about the RPM solutions, according to Allis. These partnerships are usually closed with hospitals, clinics, and academic research institutions, offering continuous tracking and analysis of cancer patients’ physical/mental health for HCPs. There are a few RPM-focused partnership examples also with the pharmaceutical companies. For example, Kaiku Health, offering a remote cancer symptom tracking and management platform for patients and HCPs, has closed several partnerships with the pharma companies such as Roche, Amgen, Merck and Novartis.

- Telehealth, Digital Therapeutics (DTx) and m-Health Apps, 10%: The telehealth services, DTx solutions and m-health applications have been the core of the 10% of partnerships on average in each year, according to Allis. These solutions offer patient support services for engagement, treatment adherence, teleconsultations, and symptom management. The partnered companies for this service and technology group are hospitals, digital health and pharma companies, insurers and some digital health ecosystem builders.

The number of partnerships in the digital oncology solutions market has been increasing since 2014, with over 300 deals being recorded by March 2023. The partnerships in the market segment involve various stakeholders in the healthcare and digital health markets, while concentrating on four main partnership areas: AI/ML technologies, RPM solutions and services, RWD/RWE services, and telehealth, DTx and mobile app solutions.