Article

Unveiling the Centre of Digital Oncology Investments: Which Region Takes the Lead?

Jun 13,2023

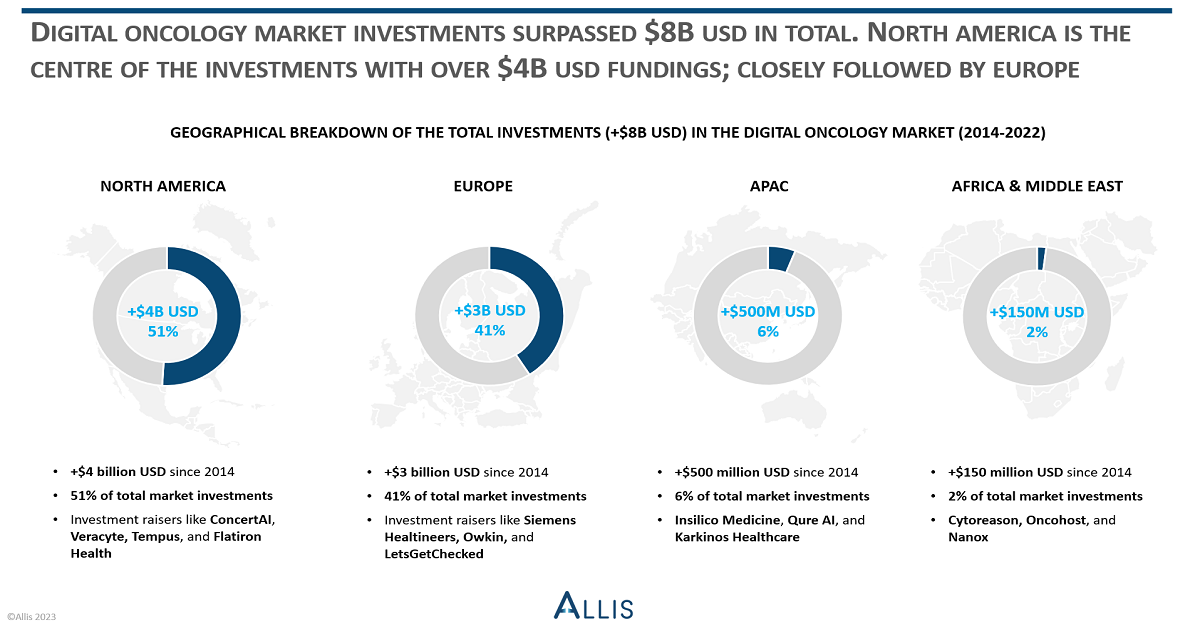

Digital oncology market segment accumulated $8B+ across 150+ funding rounds since 2014. One region emerged as the hub for the investments.

Digital oncology solutions consist of various digital health solutions that provide cancer diagnosis and clinical decision support for HCPs, facilitate symptom tracking and management support for cancer patients, and offer clinical research tools for sponsors and research sites.

Similar to other digital health markets, the growth of the digital oncology market relies on, among other things, the investments to drive innovation, accelerate research and development, and bring cutting-edge solutions at the forefront of cancer care.

During the period of 2014-2022, the market has attracted more than $8 billion USD investments in over 150 deals, grew at a CAGR of 26% (Allis.health). In this period, the average deal size hit over $48 million USD per funding deal.

Amidst the COVID-19 pandemic, there was an upsurge in investments within the digital oncology market segment. In 2021, the digital oncology solution providers secured over $4 billion USD investments across 29 deals, marking a growth of 250% YoY increase in total investment amount. This equates to an average funding amount of $130 million USD per funding round in the market segment, and CAGR of 47% between 2014-2021.

Some of the major investments that happened in 2021 in this segment include Siemens Healthineers’ $2.3 billion USD, Veracyte’s $550 million USD, and Insilico Medicine’s $255 million USD funding amounts.

Following the subsiding of investment hype caused by the global pandemic, the fundings for the digital oncology solutions experienced a downward trend, reaching around $1.5 billion USD with a YoY decrease of 64%. Moreover, the average investment deal size during this period was reduced to approx. $40 million USD per round.

The investments in the digital oncology market are distributed across APAC, EMEA, Europe and North America. The breakdown of investments in each region is:

- North America, 51%: Overall, solution providers in the US and Canada have been the primary recipients of investments in the digital oncology market segment since 2014, capturing approximately half of the total funding (i.e., $4B+ USD). Digital oncology solution and service providers in North America have consistently served as the focal point for investment activities, except in 2021, when European solution developers received the majority of investments. Leading players in the market, including ConcertAI, Veracyte, Tempus, and Flatiron Health, have emerged as top funding raisers since 2014 in North America.

- Europe, 41%: Digital oncology solution providers in Europe account for 41% of the total investments (i.e., $3B+ USD) in the market segment since 2014, very closely following after North America. Particularly in 2021, when the COVID-19 triggered the surge in investments, Europe became the primary recipient of the majority of the investments. The digital oncology solution providers such as Siemens Healtineers, Owkin, and LetsGetChecked in Europe secured significant funding from the investors. Overall, Europe ranks as the second leading region, after North America, in terms of investment volume between 2014-2022.

- APAC, 6%: The APAC region has received 6% of the total investments (i.e., $500M+ USD) in the digital oncology market since 2014, with notable contributors such as Insilico Medicine, Qure AI, and Karkinos Healthcare. The highest season of funding for the region was in 2021 when the investments reached their peak in the digital oncology market.

- Middle East & Africa, 2%: EMEA is the region with the lowest volume of investments received by the digital oncology solution providers. The companies operating in EMEA have received overall 2% of the total market segment fundings (i.e., $150M+ USD) since 2014. The solution providers who contributed to the fundings in the region include Cytoreason, Oncohost, and Nanox among others.

The digital oncology market has attracted significant investments since 2014, amassing over $8 billion in 150+ funding rounds. North America and Europe emerged as primary investment hubs, with key players like ConcertAI, Veracyte, Tempus, Siemens Healthineers and Flatiron Health leading the way. The COVID-19 pandemic drove a surge of investments in 2021, particularly in Europe, while APAC and EMEA lagged behind in investments.