Article

What are the 4 Obstacles in Automated Insulin Delivery Systems (AID)?

Apr 06,2023

The interest for the Automated Insulin Delivery (AID) systems is increasing. The major competitors are making moves to close partnership deals for AID. However, there are at least 4 obstacles that they must overcome to grow their AID business and set themselves apart.

Lately, there have been some noise and movement around the automated insulin delivery (AID) systems, otherwise known as closed-loop system or artificial pancreas.

An AID system basically consists of a continuous glucose monitoring (CGM) device, an insulin pump, and algorithms to make fully- or semi-automated insulin delivery decisions. While the fully automated system functions without requiring any input from the user, the hybrid version of this technology still needs the manually entered information from the users for accurate insulin delivery. Therefore, it requires a mobile app, or a different controller device.

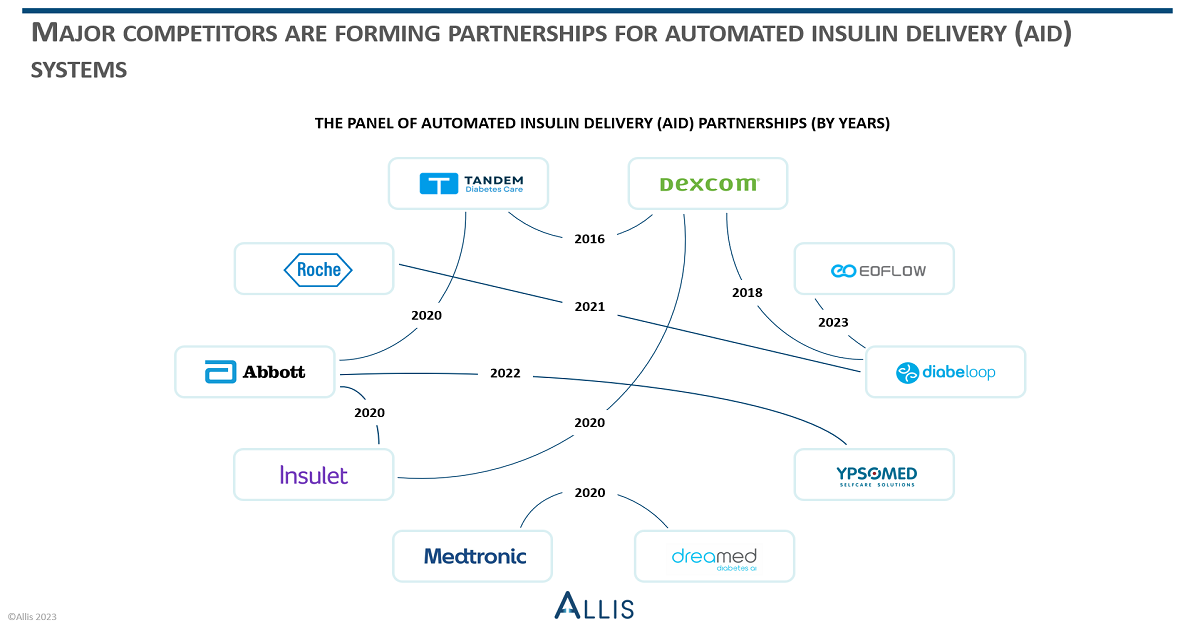

In a nutshell, this next-gen digital diabetes solution connects the dots between medical diabetes devices through the mobile apps and intelligent algorithms. And it seems that the competitors have already started to show their interest to take place in the offerings. In the CGM device and software segment, the solution providers such as Abbott and Dexcom are on the pole position, keeping themselves busy with forming partnerships with AID system developers as well as preparing their CGM devices for better data integration.

Abbott has closed partnerships with Ypsomed and CamDiab in some regions of the EU market, while in the US, they are in partnership with Insulet and Tandem Diabetes Care for device integrations. The company recently announced the FDA approval of its FreeStyle Libre 2 and 3 for the use of automated insulin delivery.

Dexcom, on the other hand, is also leveraging the partnership with the pump developer Insulet, for the tubeless AID system Omnipod 5 and who acquired the pump-based AID technology from Bigfoot Biomedical for USD 25 million recently.

Another innovative competitor Diabeloop - who is increasing the partnership network with Dexcom, EoFlow, Roche Diabetes, and others - is not targeting only offering the AID service with CGMs, but also striving to include the insulin pen users through the partnership with BIOCORP in 2021.

Tandem Diabetes Care, as a pump developer, started to leverage its partnership with Dexcom since 2016 to use the Dexcom’s CGMs connected to its pump in the Control-IQ technology for hybrid closed loop system. The company has also closed a development and commercialization deal for closed loop system with Abbott in 2020.

Medtronic on the other hand prefers a solo ride in terms of device partnerships, as the only manufacturer of both an insulin pump and a CGM. The company has two FDA approved hybrid closed-loop systems, Minimed 670G and 770G. However for the upcoming MiniMed 780G advanced AID system, the company partnered with DreaMed Diabetes to use its algorithm.

There are also the failed partnership attempts, such as the one between Eli Lilly and Ypsomed. The partnership, signed between the two in 2020 to commercialize YpsoPump for the purpose of AID system in the US, had backfired in December 2022, because Eli Lilly wanted to focus on its own drug portfolio.

The Obstacles in Automated Insulin Delivery Systems

Even though there are increasing activities for developing and improving AID systems, the currently available solutions are more or less similar in terms of the services and features. Therefore, the solution providers must overcome several other obstacles to differentiate themselves and to grow their business. Some of these obstacles are:

- Too high costs: An average out-of-pocket price of an insulin pump is around $6-7,000, plus the annual cost of $2-3,000 for the supplies. And average annual out-of-pocket price range of a CGM is around $1-4,000, including the supplies. The total annual cost of the devices in an AID system already ranges between $9-14,000. Keeping in mind that the AID system targets currently only the insulin dependent diabetes patients, it is very crucial for the solution providers to reach to as many of these patients as possible with competitive pricing options.

- Limited health plan coverage: Coverage of the AID systems is a concern for the users who would like to benefit from the technology. Beside the high cost of the system components and their maintenance, the users also have to keep track of their insurance coverages for every component of the AID system, with varying percentages of coverage depending on the insurers. This creates an extra burden on the people who might be willing to switch from their insulin pens or single pumps to AID systems.

- Safety and accuracy: CGM readings can be affected by factors such as sensor accuracy, signal loss, or interferences with medications. In the case of pumps, FDA had kept recalling several insulin pumps, such as from Medtronic and Insulet, for battery or software related issues in past. Overall, there is a high need for clinical studies and continuous developments to achieve better accuracy and reliability of the software and devices. Having in mind that AID systems are not the cheapest option among the other diabetes management technologies, the solution providers must ensure flawless functionality. This will also be helpful not only to convince the users to use an AID system but to onboard the payers to cover it.

- Size issue: Bulky devices placed on the body of patients who need continuous tracking and injection of insulin are not also the most favourable part of AID systems. Looking back how the CGM devices have become smaller and lighter, the insulin pumps that are attached to the body of patients should also follow the same path to make AID solutions more attractive. Companies such as Insulet, EoFlow, and even Tandem Diabetes Care with its latest acquisition of the patch pump developer AMF Medical, are already targeting to leverage this point and use it to set themselves apart in the market.

In conclusion, the interest on the automated insulin delivery solutions has started to rise. The major medtech and digital health companies are leveraging their past experiences and network of partnerships in developing a holistic insulin delivery with AID systems. However, there are at least four main obstacles in the AID sector, namely the cost, coverage, safety and accuracy, and the size of the devices, that are waiting to be overcome by the competitors in order to accelerate and sustain the growth of their businesses.