Article

What Drives the Partnerships in the Digital Therapeutics Market?

May 03,2023

Digital therapeutics (DTx) solutions market keeps evolving and developing, and partnerships play a key role in that. What are the purposes behind these partnerships in the DTx market?

The digital therapeutics (DTx) is still a forming and developing subsegment of digital health market, delivering therapeutic interventions through software programs that are backed by clinical evidence and comply with the safety and security regulations.

Even though there are a few examples like Pear Therapeutics who has filed for bankruptcy in early Q2 2023, looking at the increasing number of partnerships, there is a continuing interest among the healthcare stakeholders for the DTx solutions.

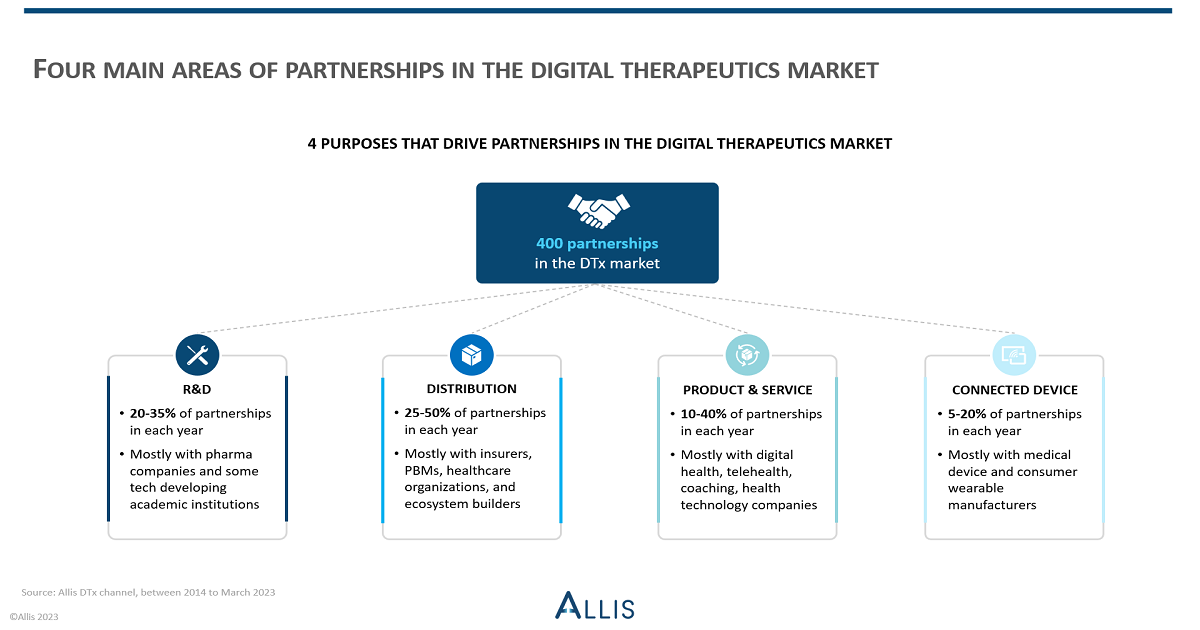

Allis recorded more than 400 partnership deals in the digital therapeutics market since 2014 until March 2023. The number of partnership deals peaked both in 2020-pandemic period and in 2022-post pandemic period.

Most of the partnerships of DTx companies have been with the pharmaceutical and insurance companies.

For example, Biofourmis and Chugai Pharmaceutical partnership that has started in 2020 for endometriosis pain assessment, expanded in 2023 for virtual specialty care service development for endometriosis patients in the US.

Novartis and Dawn Health also announced a partnership in the beginning of 2023 to develop chronic condition management tools for MS, hypertension, or breast cancer patients among others.

Some of the pharma partnerships of DTx companies also involves large upfront and milestone-based investments from the partners. For instance, Boehringer Ingelheim and Click Therapeutics have signed a $500 million USD partnership in 2020 for a digital treatment for schizophrenia. Not long ago in 2022, Sanofi also invested $30 million USD into DarioHealth’s multi condition digital therapeutics platform.

On the other side, personalized digital therapeutic program provider Virta Health was added into Blue Shield California insurance provider network in 2023. Also, Kaia Health announced the insurance partnership with Mutual of Omaha in Nebraska in the US again in 2023.

There are four main purposes that drive the partnerships in DTx market:

- Research & Development: Between 20-35% of partnerships in each year in the DTx market are R&D partnerships according to Allis. Mostly the pharmaceutical companies like Novartis, Eli Lilly, Pfizer, but also a few academic organizations developing new digital interventions, involved in these partnerships. The R&D collaborations with the pharma companies usually target core disease areas of the pharma company, to develop a companion app for the patients on specific pills in the market. In return the DTx companies access the pharma’s know-how in clinical development, sales and commercialization through these partnerships.

- Distribution: Between 25-50% of the partnerships in each year in the DTx market are distribution partnership according to Allis. Most of the partnerships in this category involves the health plans, pharmacy benefits managers (PBMs), digital health ecosystem builders, healthcare organizations and a few pharma companies. Distribution partnerships with the pharma usually are about commercialization of the product in different countries. Whereas with the insurers, healthcare organizations, ecosystem builders, and pharmacy benefits, DTx companies aim for higher number of prescriptions and users, as well as reimbursement opportunities for their solutions.

- Product & Service Enhancements: Between 10-40% of the collaborations in the DTx market tend to focus on the product and service enhancements in each year according to Allis. These involve adding a service or tech capabilities of other companies into the DTx solution, e.g., Feel Therapeutics and YourCoach.Health partnership for adding coaching services for Feel’s users. Through these partnerships, DTx providers expand their service offerings or even therapeutic area coverage, e.g., Sword Health expanded services for its MSK patients with diabetes through partnership with Onduo by Verily.

- Connected Device: Between 5-20% of partnerships with the DTx companies tend to be related to connected devices in each year according to Allis. These partnerships allow DTx providers to connect their mobile apps with the disease specific medical devices or consumer wearables like Fitbit, to track and transmit data into the app and display data dashboards that can be shared with the HCPs. For instance recently, DarioHealth partnered with Dexcom to integrate the CGM data from the users in its platform.

Overall, partnerships play an important role in the DTx market. These partnerships are primarily driven by research and development, distribution, product and service enhancements and connected devices. By forming these collaborations, DTx companies gain access to expertise and resources that allow them to develop and improve digital interventions, commercialize solutions in different countries and for a range of disease areas, get reimbursement, and provide ongoing physical health data tracking of the users.