Article

Where Do the Investments Go in the Digital Therapeutics (DTx) Market?

Jun 01,2023

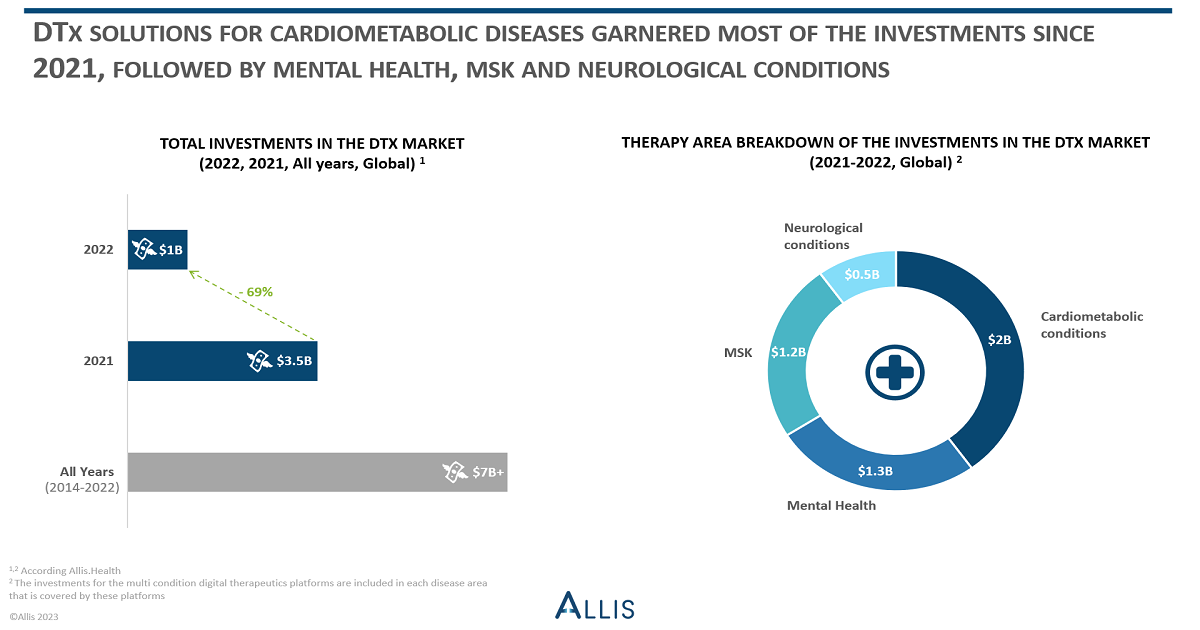

DTx investments peaked at $3B+ in 2021, normalizing in 2022. Four therapy areas secured $500M+ funding since 2021. One disease area emerged as the investment leader.

Digital therapeutics (DTx) is a developing field in the digital health market, which combines technology and healthcare to deliver evidence-based interventions that are compliant with the safety and security regulations.

Investments play a pivotal role in driving the growth of the market segment and the development of innovative and effective DTx solutions.

Between 2014-2022, DTx market accumulated more than $7 billion USD fundings in more than 250 deals (Allis.health). This can be translated into an average investment deal size of $28 million USD per funding round.

The DTx market segment saw a significant increase in the investment amounts, specifically in 2021 with the COVID-19 pandemic period investment boom. Only in 2021, the DTx solution market received around $3.5 billion USD investments, with approx. 2,500% YoY growth in total investment amounts. The average funding deal size in 2021 for the DTx solution providers was $58 million USD. Consequently, the investment market for the DTx solutions grew at a CAGR of 46% from 2014 to 2021.

The major investments in 2021 include Hinge Health’s $600 million USD, Noom’s $540 million USD and Sword Health’s $299 million USD funding rounds.

In 2022, the investment amounts and number of deals for the DTx market segment have decreased to normal ranges, reaching around $1 billion USD. The average deal size in the year was $42 million USD.

There are 4 most targeted disease areas by DTx solution providers, which have raked more than $500 million USD investments in total since 2021. These are1:

- Cardiometabolic Conditions, $1.9B USD: Keeping the top spot, DTx solutions covering cardiometabolic conditions have raised most of the fundings, approx. $1.9 billion USD investments since 2021. These DTx solutions typically include conditions like prediabetes, obesity, diabetes, hypertension, NAFLD, etc. Noom, Biofourmis, and Better Therapeutics are some of the cardiometabolic DTx solution providers who raised substantial amount of fundings since 2021.

- Mental Health, $1.4B USD: DTx solutions offering mental health services came as the second in line, with $1.4 billion USD total funding amounts since 2021. The mental health digital therapeutics platforms generally focus on anxiety, depression, stress, panic and mood disorders among others. Some digital therapeutics solution providers for chronic conditions have also started to incorporate mental health services into their platforms, e.g., Vida Health which offers Diabetes & Depression program. Noom, Pear Therapeutics, Vida Health and Woebot Health are the examples of the DTx providers offering mental health service who also received hefty investments since 2021.

- Musculoskeletal (MSK) Conditions, $1.2B USD: DTx solutions which offer services for people with MSK conditions have raised around $1.2 billion USD fundings and took the third position in the most invested therapeutic area list since 2021. MSK conditions have also been integrated into the other chronic condition DTx platform providers like DarioHealth. Hinge Health, Sword Health, Omada Health and Kaia Health are some of the DTx providers for MSK conditions who also received significant fundings since 2021.

- Neurological Conditions, $530M USD: DTx solutions covering neurological conditions including neurodegenerative and neurobehavioral conditions such as ADHD, dementia, Alzheimer’s, Parkinson, stroke recovery, etc. have raised total of $530 million USD since 2021. Typically, the neurological DTx solutions are focused on the sub-conditions in neurology, and not being integrated into other chronic conditions like in the case of mental health, cardiometabolic and MSK solutions. Mindmaze, Akili Interactive, Cognito Therapeutics and Medrhythms are part of the DTx solution providers in this category which fairly contributed to the fundings since 2021.

The digital therapeutics (DTx) market has experienced significant investment activity, reaching its peak in 2021 with over $3 billion USD poured into the industry. While investment levels returned to normalcy in 2022, cardiometabolic, mental health, MSK and neurological conditions stood out as the primary recipients of fundings. Among these, cardiometabolic conditions emerged as the frontrunner, attracting the largest share of investor attention.

Visit DTx Channel on Allis.Health to find more on the fundings, partnerships and business opportunities in digital therapeutics market or request a demo from Allis team!

1 The investments for the multi condition digital therapeutics platforms are being included in each disease area that is covered by these platforms.